From Uncharted Territory to Economic Odyssey: Unveiling the Surprises of 2024

Entering the realms of 2024, the Year of the Dragon unfolds with an unexpected sense of surprise, contrary to the initial perception of a year devoid of unforeseen twists. Amidst the overused descriptors like “uncharted” and “unprecedented,” a tapestry of uncertainties is woven, characterized by a unique blend of power, strength, and transformative energy.

In the months ahead, a plethora of challenges awaits the world, with elections scheduled in 70 countries, many grappling with the absence of complete democratic representation. In the United States, where elections loom in 11 months, uncertainties surrounding recession and inflation add layers of complexity. The Federal Reserve faces the daunting task of reducing inflation to 2%, entailing potential hurdles like wealth destruction and an imminent economic downturn. Global economic intricacies, ranging from high debt levels to declining birth rates and geopolitical tensions, contribute to the intricacy of the unfolding narrative.

The negative trade growth reported by UNCTAD in 2023 has left its mark on potential interest rate decisions by the Federal Reserve. Crude oil prices, influenced by geopolitical events such as the conflict between Israel and Gaza, remain volatile. Despite a temporary oil price rally reaching $95 in September, subsequent retreats to $64-$70 raise concerns about the elusive economic “soft landing.” Troubling data on delinquencies in credit card debt, auto loans, and small business loans add layers of uncertainty to the economic landscape.

The skepticism voiced by UBS CEO Sergio Ermotti regarding controlling inflation hints at an undercurrent of caution despite apparent positive trends. Divergent oil price forecasts for 2024, ranging from $70 to $90 per barrel, contribute to the overall unpredictability of the economic landscape.

While a recent dip in global inflation is observed, the fragility of the world economy remains a constant in 2024. The tightening of monetary policy hasn’t eradicated challenges, with high inflation, the repercussions of expensive oil, and lingering geopolitical tensions shaping the economic reality. Major central banks approach interest rate changes cautiously, and the resilience of the U.S. economy leans, in part, on substantial government borrowing. Concerns about potential recessions in Europe, China’s economic slowdown, and a surge in protectionism further cloud the horizon. The possibility of a second term for President Trump introduces the specter of deeper tax cuts and an escalating trade war, transforming the global economic journey into more of an unpredictable adventure than a soft landing.

In response to rising inflation, companies employ stealthy tactics to boost prices, such as unbundling services and implementing surge pricing. There’s speculation about potential regulation and consumer resistance in 2024, but companies seem determined to explore new avenues for revenue.

The EIU opinion poll forecast offers a glimpse into potential geopolitical scenarios, signaling outcomes like the Labor Party securing a majority in Britain, a peace deal between Russia and Ukraine post-October 2024, and a Democratic nominee winning the U.S. presidential election. Projections for Eurozone and global GDP growth add to the intricate web of possibilities, underscoring a perceived disconnect between mainstream media and the core reality of their audience. The EIU also foresees a period of tempered global growth in 2024 without anticipating a recession. Projections indicate a real GDP growth of 2.2%, aligning with the estimated expansion rate in 2023. Europe, led by Germany, is expected to see swifter growth, balancing a more subdued expansion in the United States. China’s economy is predicted to grow by 4.8%, supported by moderate stimulus measures. The EIU envisions progress in resolving supply-chain issues and lower commodity prices, resulting in a decrease in inflation in developed economies to 2.4% in 2024, down from an estimated 4.5% in 2023, suggesting the absence of a wage-price spiral. While prices, particularly for El Niño-affected foods, will remain elevated, the easing inflationary pressures will likely prompt major central banks to halt interest-rate increases, with the possibility of small cuts from mid-2024. Geopolitical risks, such as Russia’s invasion of Ukraine, Israel-Gaza relations, and the US-China rivalry, remain prominent concerns.

Turning attention to Sub-Saharan Africa, growth prospects appear modest, with challenges stemming from limited elements for transformative economic growth, compounded by the impacts of COVID-19, the war in Ukraine, and debt-fueled spending. Heavy debts, defaults, and hurdles in accessing global debt markets contribute to uncertainties, with some bright spots amid persistent challenges.

Surprisingly, despite global trade challenges in 2023, including the U.S.-China trade war, the IRA in the United States, and the war in Ukraine, global trade not only survived but thrived. Adaptation, rather than retreat, became the norm, with expectations for 2024 including more intermediated trade and adjustments driven by the green revolution and supply chain security concerns.

Reflecting on these intricacies, it becomes apparent that the resilience of global trade in the face of adversities is both unexpected and impressive. Firms and nations, it seems, continue to adapt, not retreat, projecting a future where the logic of national security will guide trade dynamics for years to come.

Dec 28, 2023 Update:

“The prospect of prices reverting to pre-Covid levels appears remote. Achieving such a level of deflation would likely necessitate a historically severe recession. The Federal Reserve would strongly oppose such an outcome as its focus is on targeting inflation rather than specific price levels. Essentially, the Fed considers past inflation as largely resolved and not a significant factor in its current policy considerations.” – BofA

Key Points:

- Economic Resilience: The economy has proven resilient, with 5% growth despite over 500 basis points of Fed rate hikes.

- Fed’s Dual Mandate: The Fed may cut rates in the future not to support a weak economy but to prevent a recession and control inflation.

- Consumer Sentiment: Sticker shock and economic disparities contribute to negative consumer sentiment, despite solid spending due to job gains and wage increases.

- Holiday Season and Spending: The economy appears strong for the holiday season, supported by low unemployment, wage inflation, and relatively stable prices for goods.

- Air Travel Recovery: Air travel has rebounded, reaching pre-pandemic levels, indicating consumer confidence and discretionary spending.

- Spending Patterns: Consumers have shifted toward durable goods spending, influenced by factors such as supply chain issues, pent-up demand, and the rise of hybrid work.

- National Debt Concerns: The national debt is expected to continue rising due to deficits, with interest expenses becoming a significant challenge.

- Debt-to-GDP Ratio: The debt-to-GDP ratio is likely to keep increasing, posing economic risks if it surpasses certain thresholds, with potential implications for interest rates and inflation.

- Housing Market: Renting remains more affordable than buying in most major cities, with mortgage rates impacting the decision-making process.

- Job Market Challenges: Job growth has slowed, making it harder to switch jobs, especially for better pay, and the ratio of vacancies to unemployed workers has decreased.

Overall, the report suggests a nuanced economic picture with positive indicators but also highlights potential challenges and concerns.

Jan 10, 2024 Update:

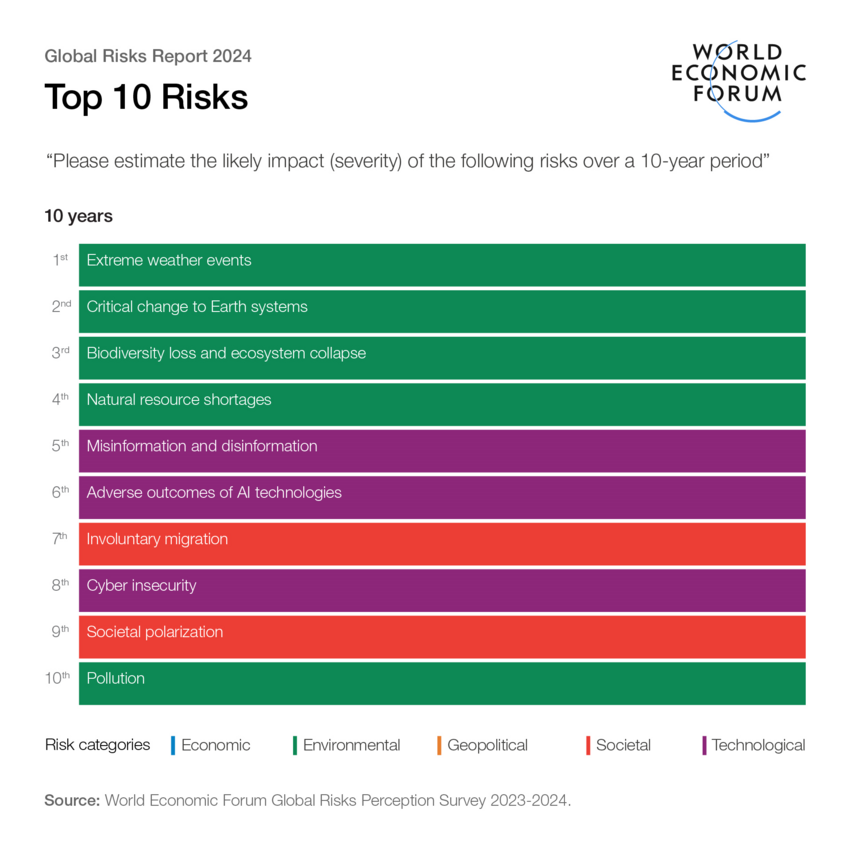

Annually, the World Economic Forum (WEF) publishes its Global Risk Report, a collaborative effort between the WEF and experts from academia, government, business, and civil society. This report assesses major global risks, spanning economic, environmental, geopolitical, societal, and technological domains, evaluating their likelihood and potential impact on global systems, economies, societies, and the environment.

Highlighted features of the WEF Global Risk Report include a comprehensive analysis of the global risk landscape, encompassing both traditional and emerging risks. It emphasizes the interconnected nature of risks, exploring how they can interact and exacerbate each other, leading to complex and systemic challenges.

Additionally, the report assesses risks based on their likelihood of occurrence and their potential impact on various stakeholders, including governments, businesses, communities, and individuals. Regional perspectives are often included to showcase how risks manifest differently across the world and to address specific regional challenges.

Identifying emerging trends and risks, such as technological advancements, climate change, geopolitical shifts, and societal transformations, is another key aspect of the report. It also provides insights into risk mitigation strategies, offering policy recommendations, business practices, and collaborative initiatives.

Ultimately, the WEF Global Risk Report 2024 serves as a vital resource for policymakers, business leaders, academics, and other stakeholders to comprehend the intricate and interconnected nature of global risks. It aids in informing decision-making and risk-management efforts at the global, regional, and local levels.

WEF Risk Reports General Overview

- Emerging Risks: The report typically identifies emerging risks to the global economy, environment, and society. These could include issues like cybersecurity threats, geopolitical tensions, or the rise of new technologies.

- Economic Uncertainty: Factors affecting global economic stability are often highlighted, such as fiscal policy challenges, trade tensions, or market volatility.

- Environmental Concerns: Climate change and its impacts on businesses and communities are usually a major focus, including extreme weather events, resource scarcity, and biodiversity loss.

- Geopolitical Risks: The report may discuss geopolitical tensions, conflicts, and their potential implications for international relations, trade, and security.

- Technological Risks: Emerging technologies like artificial intelligence, biotechnology, or the Internet of Things can bring tremendous benefits but also pose risks related to privacy, cybersecurity, and job displacement.

- Social Risks: Issues related to social instability, inequality, demographic changes, and public health crises might be addressed, especially in light of recent events like the COVID-19 pandemic.

- Risk Interconnections: The report typically explores the interconnected nature of risks and how they can amplify or exacerbate each other. For example, how a cybersecurity breach could impact financial markets or how climate change might lead to increased migration.

- Resilience and Adaptation: Strategies for building resilience and adapting to these risks are often discussed, including policy recommendations, business practices, and community initiatives.

It’s important to note that the specific contents of the Global Risk Report vary each year based on the prevailing global conditions, emerging trends, and priorities identified by the World Economic Forum and its partners. For the most accurate and up-to-date information, I recommend visiting the WEF’s official website or accessing the latest report edition if available.

April 11, 2024 Update:

- Morgan Stanley: Market Trends Indicate Confidence in a ‘No Landing’ Economic Scenario.

- April CPI/ US: inflation rises to 3.5%, higher than expectations.

- US President Joe Biden says rising inflation report may delay interest rate cuts.

- Regan Capital: the YoY core inflation reading rose to 3.8% in March; rate cuts unlikely anytime soon, a prolonged period of stable rates, maybe more rate hikes in the future.

| Labor | Sentiment | Private Sector | Inflation | Assets | Fed % | |

| Hard Landing | Employment ↓ | Demand ↓ | Profits ↓ | -↓ | -↓ | -↓ |

| Soft Landing | Employment ~ | Demand ~ | Profits ~ | -↓ | ~ | ~ |

| No Landing | Employment ~↑ | Demand ~↓ | Profits ~↓ | +↑ | -↓ or +↑ | +↑ |